What Is paygine

Paygine is a financial platform designed for currency payments in the world of cryptocurrency and currency exchange with coins can also be payments for "real" goods,

Paygine itself can be used by all parties including companies, entrepreneurs and individuals or groups Based on the needs of international banks and financial organizations, the founder

Best2Pay decided to create a new platform united by an IT system with a new platform called Paygine.

Paygine itself was launched by international banks and financial organizations, to simplify and shorten payments or buy and sell transactions in the world of cryptocurrency The main competitive advantages of Paygine over similar projects are being able to utilize

services and technology Best2Pay currently used by FinTech's business,

e-commerce, and so on.

The Paygine platform will offer the following services by utilizing

Best2Pay Existing technology:

paygine credit card

coin paygine ataw (PGC)

a payment tool called FinTech

exchange tool in the world of cryptocurrency

Paygine currency in the world in gital.

The company's financial technology proposes solutions to different problems but no development or support from surrounding communities, the problems facing the Paygine team have a dream to develop their own paygine to advance and increase the existence of the salary redemption tool in the cryptocurrency world. IN THE MARKET AND BORROWING ONLINE.

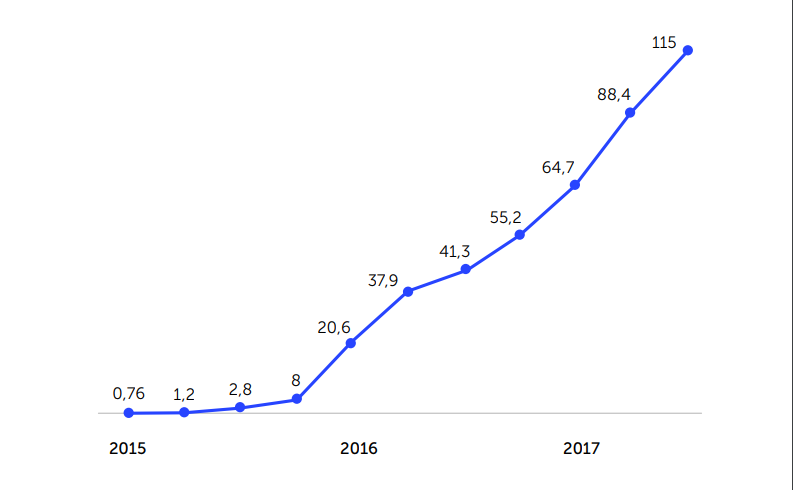

Revenue 2015-2017 per month, loan payments, and inter-peer transfers

(USD, millions)

The Paygine platform will offer the following services by utilizing the existing Best2Pay technology:

Transferring cryptocurrency to / from bank card;

Pay in stores and shops using cards in cryptocurrency;

Receiving cryptocurrency as payment for goods and services in an online store;

Transfers cross-border fiat currencies using cryptocurrency at minimal cost;

Maintain wallets in both fiat and cryptocurrency currencies with the ability to easily and quickly convert funds between them.

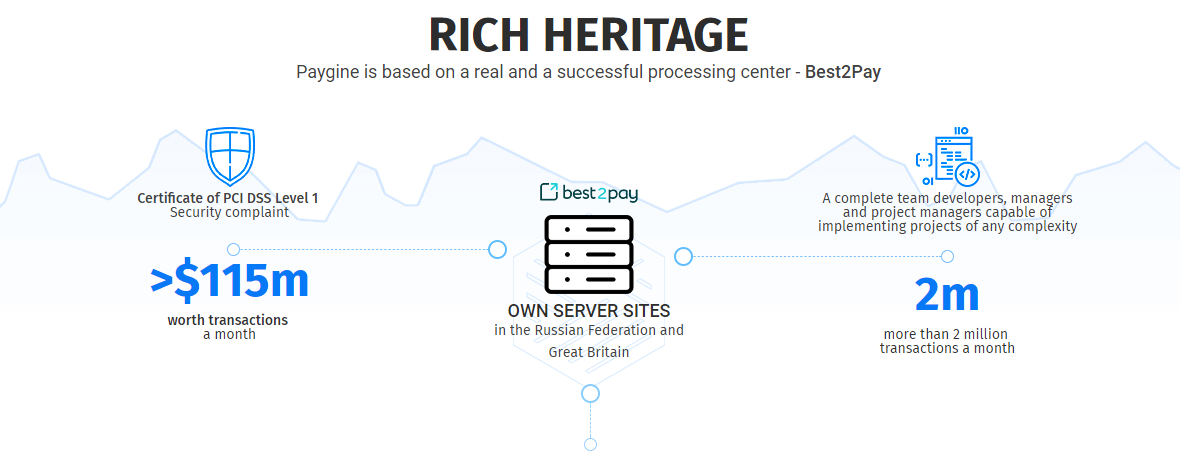

Best2Pay and established in the UK in 2012 by experts from the banking sector with experience in executing projects in American Express, SEB, Raiffeisenbank, Bank St. Petersburg, Russian Standard Bank and Sberbank services.Best2Pay utilizes projects from the fintech and e-commerce fields to serve more than 1.5 million subscribers, whose numbers increase by 34% each month.Fest2Pay platform allows to implement projects of any complexity, which will taking into account the unique features of the business processes, infrastructure and client clients' target clients

We came up with the idea to build an open financial platform that includes our own bank (the platform-owned bank) in 2017. At that time, we, together with our partners, launched a bitcoin-based remittance system for money transfers from the US to Mexico. We have developed an IT system, resolved all legal issues with the help of lawyers, and obtained legal opinions that affirm the legality of our operations and actions.

It seems that only one small thing is lacking - to find a bank ready to cooperate - and that's where our trouble starts. As soon as they learn that we will use Bitcoin as a method of payment, the bank will immediately refuse to serve us, regardless of all the documents and legal opinions provided. We faced the same problem when we tried to arrange the last money transfer service in Europe. All solutions are too complex - with many intermediaries - and do not guarantee to operate steadily for more than 1 or 2 months, even considering that, in addition to having legal opinions, we comply with all AML / KYC requirements. But this does not help. Banks and financial institutions simply refuse to work with us when they hear "bitcoin", for no reason at all!

The second problem we face in the United States and Europe is that even if some financial institutions will not stop negotiating after hearing "bitcoin", it turns out they have no white label option and can not provide all the services we need through the API. This resulted in our clients having to contact our partners directly, submit all the documents, use their interface, etc. As we know later, more than 79% of Fintech and CME startups associated with crypto are struggling with these two issues. Currently, according to different estimates, the total cryptocurrency market capitalization has surpassed several hundreds of billions of US dollars - and most of the money is not available to the real sector of the economy or to real people in their daily lives! That's why we decided to offer something new in the market.

INFORMATION ABOUT TOKEN

Name

PGC token price. 1, 00 PGC = 1.00 USD

Blockchain: Ethereum ERC20

PUBLIC SALE

18 JUL 2018 - AUG 2018 17

Token use:

After the project launch, each holder will have the right to pay for goods or services with tokens in a ratio of 1 PGC = 1 USD.

All unsold token will be sent there for use on the Paygine platform in the future.

Number of tokens: 151 750 000 PGC

Tokens distributed among project investors will amount to 41 508 000 PGC (27.92%),

The tokens distributed among project team members will amount to 22 500 000 PGC (14.71%)

the tokens allocated for reserves will amount to 87 742 392 PGC (56.59%)

The pension points for payment are 1 191 608 PGC (0.78%)

budget allocation:

Bank Purchases (64.9%)

Staff (18.3%)

Legal costs (registration, license, consultation) (4.8%)

Operating costs (0.3%)

Rent (1.3%)

Buy the software and its settings (10.3%)

TOKENS DISTRIBUTION

and projected use of incomeName and token logo: PGC

Price: 1.00 PGC = 1.00 USDBlockchain: Ethereum, ERC20

Using tokens: After the project launch, each holder will have the right to pay for goods or services using tokens in a ratio of 1 PGC = 1 USD. All unsold token will be sent there for use on the Paygine platform in the future.

for more information:

WEBSITE: https://www.paygine.com/

TELEGRAM: https://t.me/paygine_official

FACEBOOK: https://www.facebook.com/paygine/

TWITTER: https://twitter.com/paygine

AUTHOR: (blackr15) https://bitcointalk.org/index.php?action=profile;u=1123100

Komentar

Posting Komentar