hallo back again with me sinta, i want to introduce ANKORUS with you, let see my article.

What Is ANKORUS

Ankorus will allow cryptoholds to buy real-world financial assets. Instead of cryptocurrency, Ankorus will create and allocate tokens whose values match their corresponding assets. The natural results we expect can be a radical breakdown for the traditional financial world, which also often serves too little

Where some rivals just expose their customers to assets, Ankorus will be completely safe.

Cryptoholders can actually diversify their portfolios across multiple asset classes. By leveraging on Innovative Technologies, Ankorus embarked on a new landscape of frictionless trade, beyond costly geographical borders and financial constraints.

MISSION

Ankorus will form an important new connection from the crypto environment to an established financial world, enriching both with a better chance and safety level.

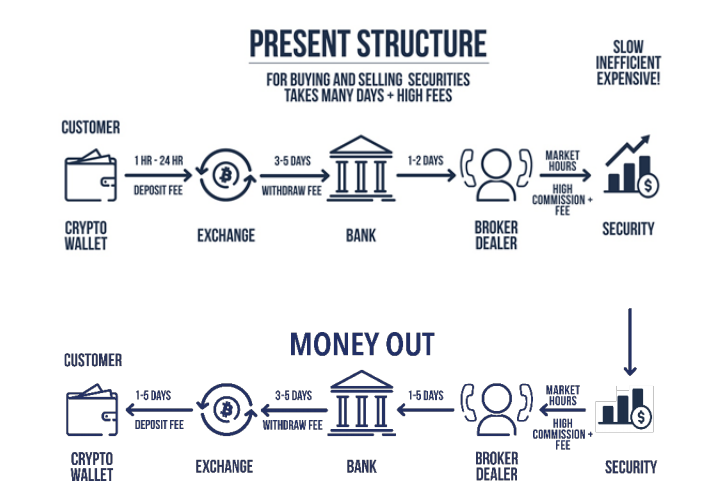

TECHNOLOGY AND PROCESS

The Anchor Token system will become an alternative to the tokenisen investment ecosystem and provide financial instruments, including stocks, bonds, futures, options, gold, silver, commodity, REITs, ETFs and sovereign debt.

When our customers buy Anchor Tokens, we will immediately purchase the appropriate assets. Ankorus, as a trusted keeper, holds this asset in reserve.

Token holders can change their Anchor Tokens at the Ankorus sign exchange exchange, AnchorNet, or change their value directly from us

TOKENIZATION SECURITY

Ankorus will be able to commit tokenise to Anchor Token from existing financial assets. Ankorus will also ask for an anchor ration in exchange for a one-time tokatization fee.

Ankorus will provide to purchase financial assets currently traded worldwide, such as AMZN, FB, SBUX, BIDU, AAPL, T-Bills and US Bonds, USD, CHF, JPY, SPY, GLD, ZKB Gold, Crude Oil.

CREATION TOKENS ANCHOR

The customer selects the financial asset to tokenize.

Customers pay Ankorus for their purchase in one of a number of currencies (this includes BTC, ETH, Ripple's XRP, BCH, Litecoin, Dash, NEO, Tether and ANK).

Ankorus brokerage dealer buys the underlying securities, as selected by the customer. Orders are filled with current traded prices.

The equivalent value of anchor Token for such security is then credited to the account customer in their smart wallet, minus a small fee and commission. The anchor token will be credited to the customer's wallet within minutes of receiving the order.

Any revenue derived from the underlying securities will be reinvested automatically into securities, giving customers a larger number of Anchor Tokens, or credited to the customer's wallet Customers can choose which option they choose.

Ankorus is the only entity that can make or break an anchor Token, thus retaining the true value that is pegged to the underlying security

TOKEN ALLOCATION

Ankorus will begin accepting contributions on November 25, 2017. Interested parties may contribute crypto to Ankorus, which will be the only form of contribution received.

The contribution period will last for 30 days, after which ANK token will be allocated to Contributor Contributors will be able to see its contribution in their smart wallet. "Hard hat" is set at 150,000 ETH.

100 million ANK (maximum supply) will be made and divided as follows:

50% publicly available.

24% is allocated to the pity of Ankorus

15% is allocated to the founders of Ankorus

5% is allocated to Ankorus advisor

3% is allocated to bounties

3% is allocated for marketing costs

ANK is allocated to founders and advisers Ankorus (amounting to 20% of total ANK) will be electronically locked for 12 months. This key will be built into a smart and visible contract in blockchain.

Shortly after the token is shared, ANK will be registered for trading on the main exchange. After about six weeks, Ankorus will enter ANK in two other exchanges.

ANK will perform some important functions in the "Ankorus" ecosystem. Customer expectations To use the Ankorus platform must have at least five ANK tokens. Having ANK token will also calculate a profitable commission when buying anchor token.

GLOSSARY

Accredited Carrier - Initial Buyers of Anchor Tokens - either from Ankorus or others via the AnchorNet platform - or obtained from third parties, nominate and identify individuals as beneficiaries.

Anchor Token - Token made by Ankorus which is pegged to the security value purchased and bought by Ankorus as global guard.

AnchorNet - The token trading platform created by Ankorus for Token Stock Tokens.

ANK Token - The ERC20 mark on the Ethereal block, for use in the "ecosystem" of Ankorus.

Broker-dealer - A brokerage firm that buys and sells securities on behalf of its customers.

Reactive Portfolio Management (RPM) - Ankorus's proprietary technology enables real-time monitoring of portfolio clients, which can also trigger the destruction of every token used in fraudulent transactions.

ROADMAP

Already achieved

Proof of concept

Business model \

White paper

The initial development of smart wallet and Reactive Portfolio Management (RPM)

The early development of a special ledger

The early development of a special ledger

The presence of social media (Twitter, Reddit, Bitcoin Talk, LinkedIn,

Telegram / sagging, medium, Facebook)

Site Ankorus.org

The following will commence on the completion of the ANK token contribution period, which runs from 25 November to 25 December 2017.

Stage One (January 2018 - June 2018)

Create Ankorus Global Custodian

Stage Two (July 2018 - December 2018)

Further development:

smart wallet

general ledger

Stage Three (January 2019 - March 2019)

Complete the development and deployment of AnchorNet, Anchor

Token Exchange Platform

Register with SEC as Electronic Communications

Network.

For more information you can visit the links I have made below:

Details Information:

Website: https://www.ankorus.org/

Facebook: https://www.facebook.com/Ankorus

Twitter: https://twitter.com/AnkorusGlobal

Linkedin: https://www.linkedin.com/company/Ackorus

Medium: https://www.medium.com/@Acorus

Telegram: https://www.t.me/Ankorus

My Bitcointalk: (blackr15) https://bitcointalk.org/index.php?action=profile;u=1123100

Komentar

Posting Komentar